A wealth-building strategy called "infinite banking" strategy has gone viral on TikTok. Millions of people have now watched rapper Waka Flocka Flame rave about the idea, which involves buying a certain type of life insurance — whole life insurance — and borrowing money from it over a long period of time instead of using a traditional loan or dipping into your savings account.

“I was like, the dumbest person on earth. I was spending money on everything,” Flocka says in some of these videos. “Man, please. [I thought] I’m gonna open up an insurance, put two, three million on my insurance, and borrow from it, and put it back in. [Now] I never lose my money, ever.”

What is infinite banking life insurance?

The Corporate Finance Institute defines infinite banking as the use of whole life insurance policies that distribute dividends to build wealth. [1] Whole is a type of permanent life insurance that does not expire and accumulates a cash value separate from the standard death benefit that insurers pay out to the beneficiaries after the policyholder dies. The goal is to increase cash flow by borrowing against an existing policy as opposed to a traditional bank.

The concept, as Flocka and other infinite banking fanatics make it sound, is easy — you open a life insurance policy that generates money, and then take out a loan against your own money. When you pay back the loan, you’re basically paying yourself back while the money in your policy continues to gain interest.

The term was coined by economist Nelson Nash in the late 1980s and popularized in his book “Becoming Your Own Banker.” According to Nash, you can use the cash value that is unique to whole life insurance policies — as opposed to other kinds of insurance, like term, that don’t have a cash value component — to act as collateral for policy loans.

But is infinite banking a viable financial strategy to increase cash flow? And can it work for you? Experts interviewed by policycentral explained that taking out a permanent life insurance policy for the purpose of building wealth isn’t a one-size-fits-all solution to financial planning. In fact, it’s not an effective strategy for most people.

And it doesn’t work like those viral TikTok videos say it does.

5 things you need to know about infinite banking life insurance

1. You’re not really taking a loan from yourself

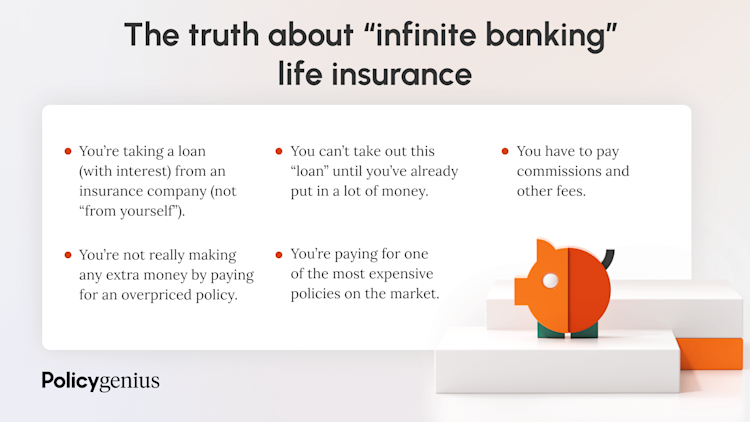

There are a few different caveats to consider when it comes to the infinite banking concept. Although it sounds nice to take a loan from yourself, that’s not how whole life insurance policies work. You’re actually taking a loan from the insurance company, and you still have to pay it back with interest. If you don’t, you risk your cash value depleting even further or your policy lapsing.

2. You have to pay commissions and other fees

Some of the videos on infinite banking posted on TikTok use credit card debt as an example of how to leverage the cash value from your whole life insurance policy: The idea is that you might as well take a loan out from your life insurance policy to pay off credit card debt, because when you repay the loan, including interest, the whole amount will get routed back to your own investments.

But that’s not how taking a loan from your whole life insurance policy works. When you pay back the loan with interest, part of that interest goes to the insurance company itself. And before you even take out a loan, part of the premiums you pay go toward fees and commissions as opposed to your cash value. “When you dig into the actual costs, people don’t realize commission on this stuff [the whole life policies] is 50% to 70% of the premium — there’s just nothing here that is unique that you can’t do yourself without the cost,” says Rick Kahler, a certified financial planner in South Dakota, and founder of Kahler Financial Group.

3. You’re not really making extra money for keeping an overpriced policy

While receiving dividends from your insurance company by holding a cash value life insurance policy might sound appealing, “If you look at the definition of dividends, it’s a return of premium payment,” says Jose V. Sanchez, a certified financial planner in New Mexico who specializes in retirement wealth. “That means that if you and I own [a policy] through a dividend-paying company, you and I just paid more this year than what we should’ve, and they’re just returning it back to us as shareholders.”

4. You need to put a lot of money into your account before you can take a loan

Unless you’re like Waka Flocka and have $2 million or $3 million lying around to put into a whole life insurance policy at once, you can’t just instantly “become your own bank” by having one of these policies, as the concept of infinite banking suggests.

Before you get to a point where you can take out a loan against your own policy, you need to accumulate a significant cash value, which takes time. “The key thing about life insurance [is that] usually, for the first five to 10 years, the commission is paid out, so it’s very hard for a policy to start to gain any momentum in building value” before that time, Sanchez says.

Think of life insurance cash value as home equity, says Patrick Hanzel, a certified financial planner and Advanced Planning Manager at Policygenius. “Similar to equity building in a home as you make mortgage payments, your cash value (equity) in a whole life insurance policy starts at zero and grows over time,” Hanzel says. “Infinite banking is not a strategy to get rich quickly.”

5. You’re paying for one of the most expensive policies on the market

Whole life insurance is five to 15 times more expensive than alternatives like term life insurance, which makes it prohibitive for most people, especially those who are young and early in their career.

To reap the rewards of a whole life policy, you’d be committing yourself to a monthly bill of around several hundred dollars for the next 10 to 15 years, if not longer. Why? Because if you stop making payments on your policy, it will lapse. This brings about a certain level of risk that other tax-favorable accounts don’t have.

When you think about funding other wealth accumulation vehicles, “for instance, with a Roth IRA [individual retirement account] you can fund it $6,000 this year and $6,000 next year. But if you lose your job or something goes sideways, you can choose not to fund it and your money will still accumulate,” Sanchez says. “With a permanent policy, you have to be in it for the long run. You have to have multiple streams of income that will give you the confidence that you won’t have income issues.” For many people, that’s a risky assumption to make.

What options do you have if you’re young and want to add life insurance into your financial plan?

The most important step is to figure out your insurance needs first.

Look at your financial obligations. Do you have a spouse, children, or a mortgage? Most young families who may have a mortgage or student loans can get coverage using a product that is low-cost and high-value, Sanchez says. Term life insurance provides that option. It covers you for the time you need financial protection the most.

Invest the difference you’d be paying in more expensive premiums into other tax-favorable accounts. You’ll have the peace of mind of knowing you can afford to maintain your separate insurance policy for as long as you need it to protect your family and other obligations.

If your goal is to build wealth, “I would say contribute to [your] own 401(k),” CFP Kahler suggests. “You can borrow money from most 401(k)s if the employer sets the plan up to let you do that. Investing in your own retirement is going to build wealth way faster.”

Sanchez holds a similar stance: “The opportunity to fully fund your 401(k) is tremendous especially in your early years,” he says. “If you’re young and able to fully fund your Roth IRA at the 10% tax bracket, that’s incredible. We’ve just become so numb to the benefit of tax deferred accounts. [They’re] not exciting, but that doesn’t decrease [their] value.”

Who might actually benefit from whole life insurance?

Generally, whole life insurance is useful when you have already established wealth you need to protect. If you’re considering what you want out of a policy and have longer-term needs, more than 20 or 30 years, “certain permanent policies do a great job at solving the need, keeping cash value low, and keeping cost low,” Sanchez says.

Whole life can have its advantages. If you’re looking to minimize your estate tax, if you’re already maximizing contributions to your 401(k) and Roth IRA, or if you have long-term dependents, a whole life insurance policy might be able to supplement your plan. “Whole life insurance and infinite banking-type wealth building strategies are never meant to be a single solution for a full financial plan,” Hanzel says.

But for most people, especially those who are early in their career or new to starting a family, other investment strategies can be a better and less risky fit. “Cash value life insurance is for very few people, or almost no one,” Kahler says. “In most cases, getting term [life insurance] is going to especially serve the young family that needs lots of insurance much better. It’s not an investment. It’s insurance and there’s a cost to it.”

Where can you learn more about financial strategies?

TikTok and other social media platforms may be disrupting the way people have traditionally gotten their financial advice, but it’s still important to do your homework and critically reflect on your financial needs and goals.

“Social media is providing more information and more opportunity to [access] this information. Infinite banking works at some level, just like every product out there works on some level,” Sanchez says. “The reality is that people who know this tool the best are the agents who sell it, because products change on a weekly and monthly basis.”

It’s best to speak to a financial advisor to make sure you have a healthy and comprehensive financial plan. Talking to an insurance professional can help you make an informed decision on which type of insurance policy makes the most sense for you. Independent brokers like policycentral are a good place to start if you’re looking for unbiased advice.