The birthplace of Motown and the center of the automobile industry, Michigan’s largest and most populous city has been drawing in new renters with its diverse cultural history and burgeoning art scene. However there are a lot of ways for your possessions to get stolen or damaged in Detroit — a city where the property crimes run high, so it’s important to make sure you’re protected with renters insurance to replace your stuff and cheaply, too.

Best renters insurance companies in Detroit

INSURANCE COMPANY | MONTHLY COST - $500 DEDUCTIBLE | MONTHLY COST - $1,000 DEDUCTIBLE |

|---|---|---|

State Farm | $15.08 | $14.08 |

Allstate | $74.00 | $64.00 |

Travelers* | N/A | N/A |

Stillwater* | N/A | N/A |

Lemonade | $25.59 | $22.42 |

*Online quotes not available.

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

STATE FARM | ALLSTATE | TRAVELERS | STILLWATER | LEMONADE | |

|---|---|---|---|---|---|

Property Coverage | $20,000 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000 | $100,000 | $100,000 | $100,000 | $100,000 |

Medical payments to others | $1,000 | $1,000 | $1,000 | $2,000 | $1,000 |

Understanding renters insurance quotes

Renters insurance coverage is more than just protecting your personal property, it also protects you from being financially on the hook if someone is injured in your home, and can pay if you need to temporarily move out of your rental unit. Here’s a rundown of the basic components of a policy that you should know when you're comparing renters insurance rates.

Property coverage: Reimburses you for any personal property that is destroyed, damaged, or stolen in your apartment and outside of it. That coverage extends to your car or storage unit.

Liability coverage: Covers legal costs if a guest is injured in your home and sues you

Medical payments to others: Covers the medical expenses if a guest is injured in your home.

Loss of use: Pays temporary living expenses if you can’t live in your rented home or apartment due to damage or repairs.

We’ve got a full explainer of what renters insurance covers here.

Is renters insurance legally required in Detroit?

Renters insurance isn’t legally mandated by the city of Detroit, but your landlord might stipulate that you get as a condition of your lease. You should read the fine print of your lease or check with your landlord if you’re not sure whether you’re required to have renters insurance.

However, even if your landlord doesn’t require it, renters insurance is still worth buying. You can get a policy with a $500 deductible to insure your belongings for about $15 a month. Plus there are more reasons to apply, which we’ll go into next.

Reasons to buy renters insurance in Detroit

Renters insurance is among some of the most affordable insurance coverage you can buy, and considering your most cherished personal belongings are typically stored in your residence or storage units, renters insurance should be a no-brainer in any city.

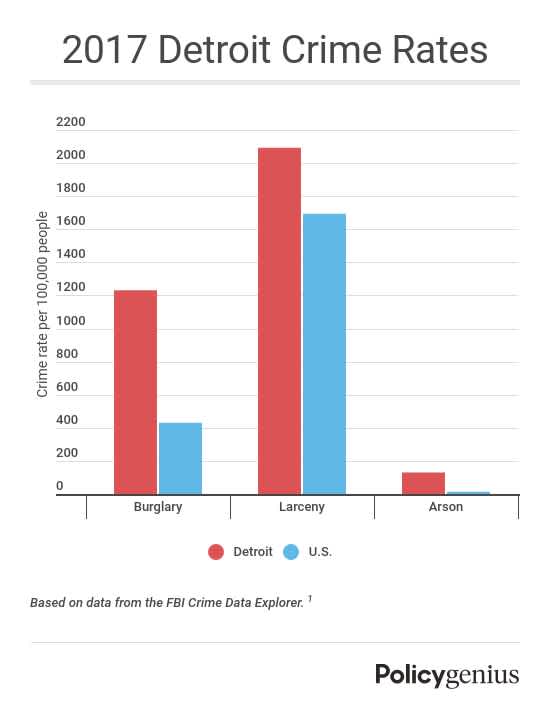

Detroit renters in particular should buy insurance because of the city’s high property crime rates. While crime rates in the Motor City have generally followed a downward trend from year to year, the rate of burglary, larceny theft, and arson are still well above the national average.

Another reason to buy renters insurance in Detroit is the cold weather. The average temperature in winter months doesn’t rise past 35 degrees, which could lead to frozen and burst pipes.

With renters insurance, you’re covered in the event a pipe bursts or the heavy weight of snow or ice causes your roof to fall in and damage your stuff. Detroit also regularly faces the risk of flooding anytime from spring to fall, so you might want to consider extra flood insurance for renters which typically isn’t included in a standard policy.

Helpful resources

Detroit tenants looking for more resources on renting and their rights should visit the following:

Detroit Housing and Revitalization Department: information on affordable housing, home repair resources and other tools to improve access to clean, safe, and decent housing.

Fairhousing Center of Detroit: a private, non-profit organization that works to help ensure equal housing opportunities throughout the metropolitan Detroit area.

Civil Division of the 36th District Court of Michigan: information on landlord-tenant proceedings in the event of an eviction.