San Francisco has some of the smartest renters in the country — are you one of them?

Savvy renters make sure they are protected by buying renters insurance, an affordable type of insurance that will replace your belongings in case of theft, fire, or one of several other covered perils. If you rent an apartment, house, or even just a room, you need a renters insurance policy. But what is the best company for 220,000 people renting in San Francisco?^

Best renters insurance companies in San Francisco

Insurance Company | Monthly Cost - $500 Deductible | Monthly Cost - $1,000 Deductible |

|---|---|---|

State Farm | $10.83 | $10.83 |

Allstate | $16.00 | $14.00 |

Travelers | $17.00 | $15.00 |

Stillwater | $15.25 | $15.00 |

Lemonade | $8.34 | $7.25 |

Methodology: We pulled renters insurance quotes online from five of the most popular insurance companies: State Farm, Lemonade, Allstate, Travelers and Stillwater. Quotes were for policies with $500 and $1,000 deductibles for a 30-year-old male apartment renter. We deferred to the most comparable coverage amounts when identical policies were unavailable.

Coverage type | State Farm | Allstate | Travelers | Stillwater | Lemonade |

|---|---|---|---|---|---|

Property Coverage | $20,000.00 | $20,000 | $30,000 | $20,000 | $20,000 |

Liability Coverage | $100,000.00 | $100,000 | $100,000 | $100,000 | $100,000 |

Loss of Use | N/A | No Max | $9,000 | $8,000 | $6,000 |

Medical payments to others | $1,000.00 | $1,000.00 | $1,000 | $2,000 | $1,000 |

Understanding San Francisco renters insurance quotes

Renters insurance policies provide renters with four types of coverage. Each policy provides coverage limits in different amounts for each type. The four types over renters insurance coverage include:

Property coverage: Reimburses your for property that is destroyed, damaged, or stolen.

Liability coverage: Covers legal costs if a guest is injured in your home and sues you.

Medical payments to others: Covers the medical expenses if a guest is injured in your home.

Loss of use: Pays temporary living expenses if you can’t live in your apartment due to damage or repairs.

Read more about what renters insurance covers.

Is renters insurance legally required in San Francisco?

Some people are surprised when their leases including a provision requiring them to purchase renters insurance — is that legal? It is indeed: California law allows your landlord to require renters insurance.

There isn’t a law that you have to have renters insurance in California, but the law does allow your landlord to require you to have insurance.

There are a couple of reasons that landlords require tenants to have renters insurance. One reason is that it protects them: if your dog bites someone or a guest gets injured in your apartment, the landlord wants your insurance to be able to pay for it — otherwise the guest or bite victim may come after him!

The second reason landlords want their tenants to have insurance is because they want you to be protected in case something happens and you need to vacate the building for repairs or replace your belongings. Better to know you’re covered. (And guess what: it’s better for you to be covered, too!)

Reasons to buy renters insurance in San Francisco

Renters insurance is one of the most affordable and easiest types of insurance to buy, and it is essential for replacing your belongings in case of common events like break-ins or fires. And for the former, that can be especially important in San Francisco, which has very high rates of property crime.

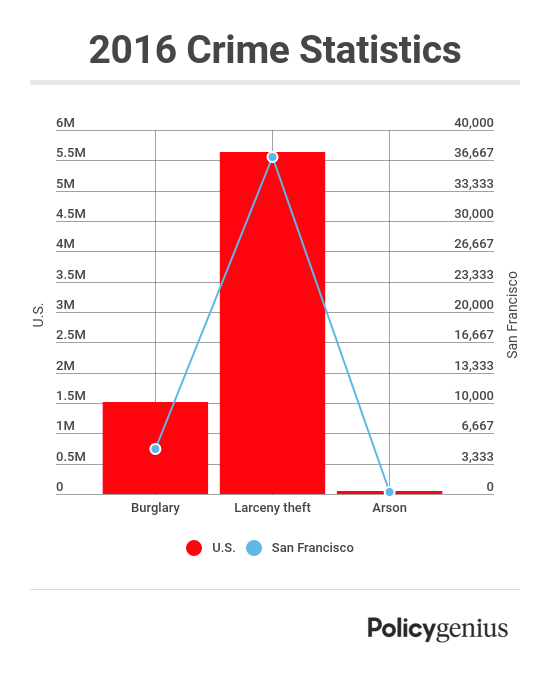

In 2016, San Francisco residents experienced nearly 5,000 burglaries, 37,000 thefts, and 255 arsons, according to data provided by the SFPD.† The property crime rates in San Francisco exceed national rates, which make it especially prudent for San Francisco residents to protect themselves.

One especially important piece of renters insurance coverage for San Francisco residents? Your property is covered even when it’s in your car. The smashed window is for you (and your car insurance to deal with, but that swiped laptop? Renters insurance to the rescue.

San Francisco has pretty mild weather year-round, which means the freezing temperatures that can lead to burst pipes aren’t a concern for San Francisco renters.‡

One big surprise for many San Francisco renters is that most renters insurance policies don’t cover earthquake damage. (The one exception: if an earthquake causes a fire and the fire damages your home, your renters insurance will honor your claim.) However, some renters insurance companies do offer option earthquake endorsements or riders, so it’s worth asking. A separate earthquake policy is also a possibility, though the premiums can be costly.

Helpful resources

San Francisco tenants looking for more resources on renting, renters insurance, and their rights should visit the following:

The Average Cost of Renters Insurance Find out what factors determine your renters insurance price — and how that price is calculated.

San Francisco Tenants Union: Read the latest edition of the San Francisco Tenants Union Tenants Rights handbook.

Housing Rights Committee of SF: Get counseling about your rights as a renter in San Francisco.

San Francisco Rent Board: Learn about San Francisco rent ordinances.

Eviction Defense Collaborative: Information and support for San Francisco renters facing eviction.

^ 1. U.S. Census

† 2. FBI CDE

‡ 3. US Climate Data